Exploration Requirements and Cost Estimates

The OHG Mining represents a high-grade, historically productive opportunity in a structurally favorable greenstone-hosted setting. With appropriate capital allocation for exploration, infrastructure, and early-stage development, this project could transition into a sustainable medium-scale gold mining operation.

OHG Mining represents a high-grade, structurally hosted gold system within a historically productive greenstone belt. The resource is currently underexplored and partially defined, with visible mineralization at depth and along strike.

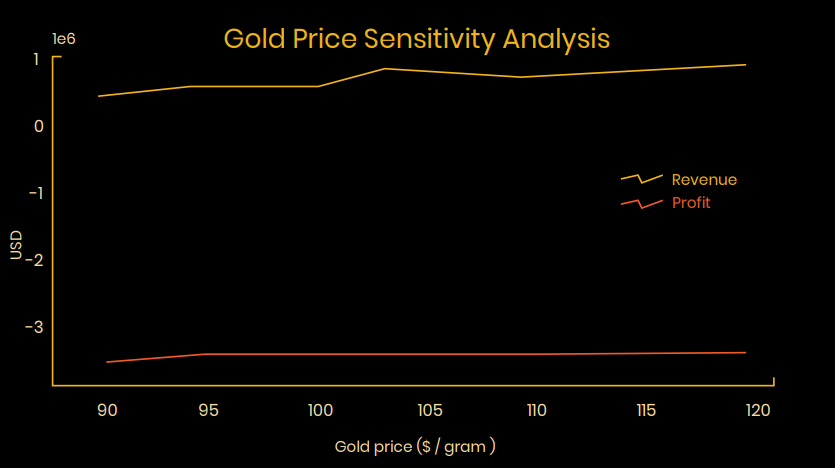

This section illustrates how varying the gold price impacts projected revenue and profit. Assumptions include a 90% recovery rate and a consistent annual throughput of 7,300 tonnes.

| Gold Price ($/oz) | Revenue/year | Net CF/year | NPV ($M) | IRR (%) | Payback (yrs) |

|---|---|---|---|---|---|

| 1,400 | $9,926,000 | $5,726,000 | -1.58 | ~7.7% | >10 (No Payback) |

| 1,600 | $12,762,000 | $8,562,000 | 17.42 | ~17.5% | 4.7 |

| 1,800 | $15,598,000 | $11,398,000 | 36.4 | ~26.1% | 3.5 |

| 2,000 | $18,434,000 | $14,234,000 | 55.37 | ~33.7% | 2.8 |

| 2,200 | $21,270,000 | $17,070,000 | 74.35 | ~40.3% | 2.3 |

| 2,400 | $24,106,000 | $19,906,000 | 93.32 | ~46.0% | 2.0 |

| 2,700 | $28,360,000 | $24,160,000 | 121.96 | ~52.8% | 1.65 |