Gold, the Last Bastion Against Monetary Disorder..

The People's Bank of China (PBoC) has announced that its official gold reserves reached 73.77 million ounces (approx. 2,294.51 tonnes) at the end of April. This represents an increase of 70,000 ounces (around 2.18 tonnes) on the previous month, marking the sixth consecutive month of growth in its gold holdings.

Gold reserves at the People's Bank of China rose by 2 tonnes in April, marking the sixth consecutive month of purchases. Year-to-date, net purchases now stand at 15 tonnes, bringing China's total gold reserves to 2,294 tonnes.

China's accumulation of gold is part of a strategy to reduce its dependence on the US dollar and reinforce the stability of its assets in the face of global economic uncertainties. The move is also motivated by growing concerns over the widening US deficit and increased borrowing by the US Treasury, which recently raised its funding requirements for the second quarter of 2025.

The Treasury Department now expects to raise $514 billion between April and June, up 317% on the previous estimate of $123 billion made in February. This revision is mainly due to a lower-than-expected cash balance at the start of the quarter, with only $406 billion available at the end of March, compared with an anticipated $850 billion.

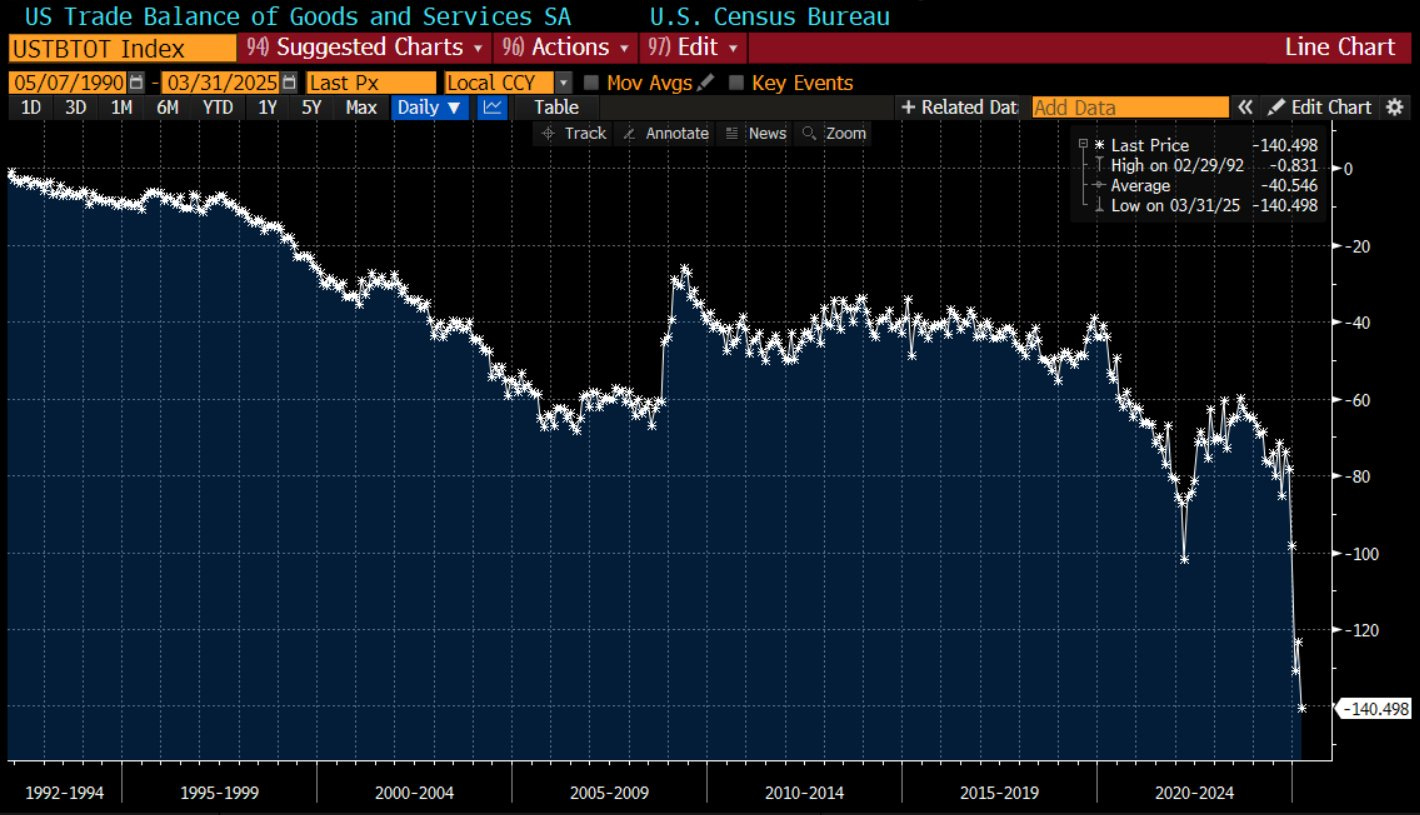

This explosion in borrowing requirements comes at a time when the United States is recording a record trade deficit, exacerbating doubts about the sustainability of the federal debt. In March 2025, the deficit reached $140.5 billion, up 14% on the previous month, largely due to an influx of imports - notably pharmaceuticals - in anticipation of new tariffs imposed by the Trump administration.

Even if this widening is partly due to a storage effect, a reduction in the deficit is logically expected in the coming months. However, this improvement may only be temporary if US consumption remains as buoyant as it has been.bly pharmaceuticals - in anticipation of new tariffs imposed by the Trump administration.

The continuing strength of consumer spending continues to fuel the trade deficit, despite protectionist measures. In March, consumer spending rose by 0.7%, boosted by anticipated purchases of durable goods, particularly automobiles.The resilience of consumption, while encouraging in the short term, could become problematic if not accompanied by an equivalent increase in exports.Many analysts believe that a reduction in consumption would be necessary to bridge the trade deficit. The new tariffs could lead to higher prices and, in turn, a contraction in demand, followed by a drop in consumption. In other words, behind the flattering figures of a dynamic economy, adjustments will no doubt be essential to ensure sustainable growth.

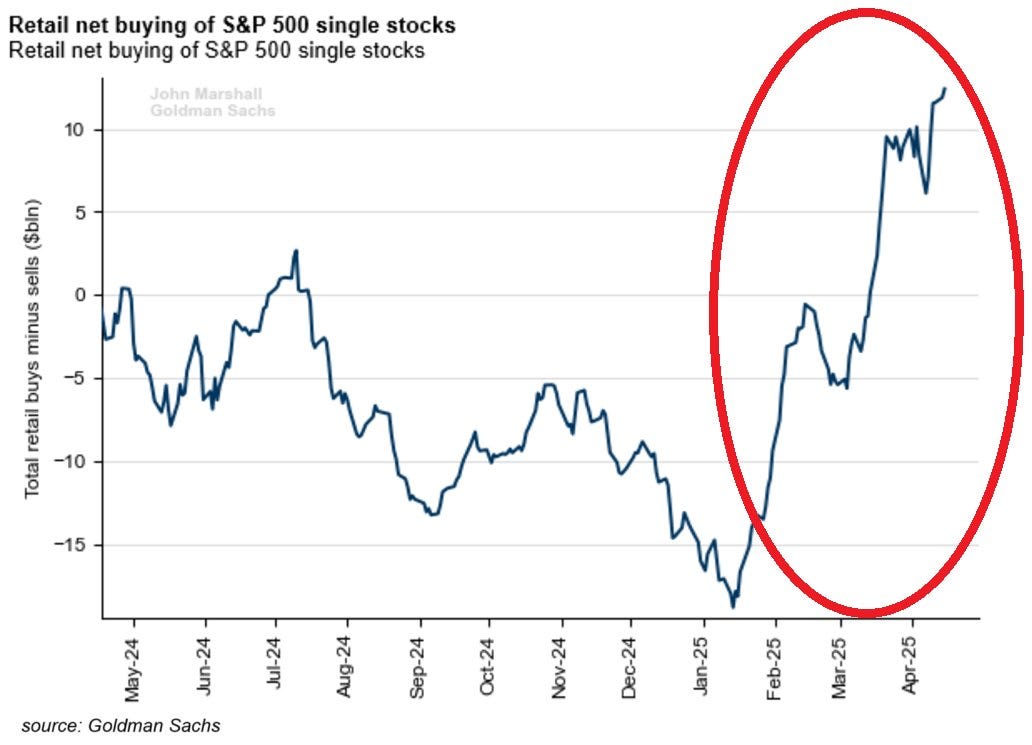

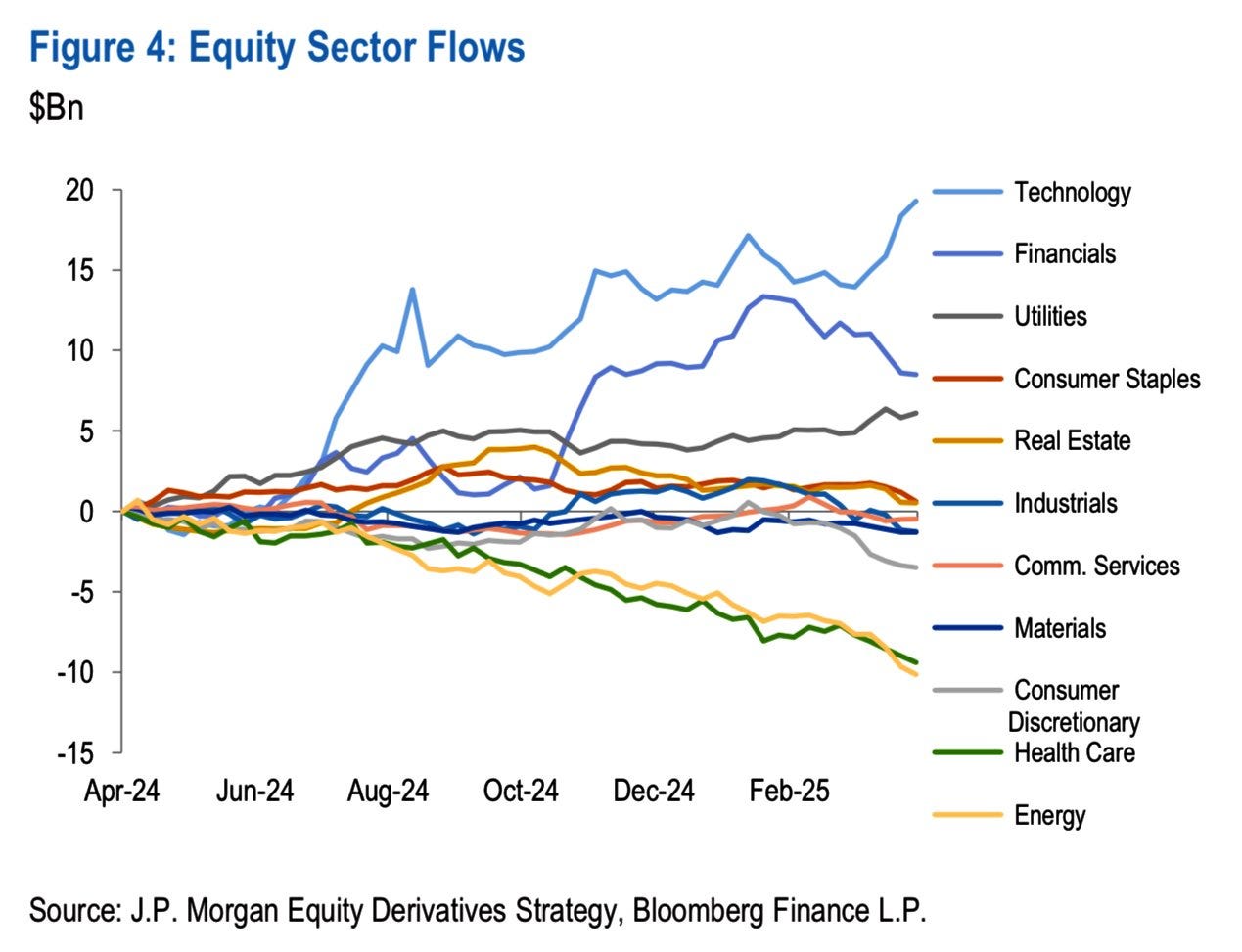

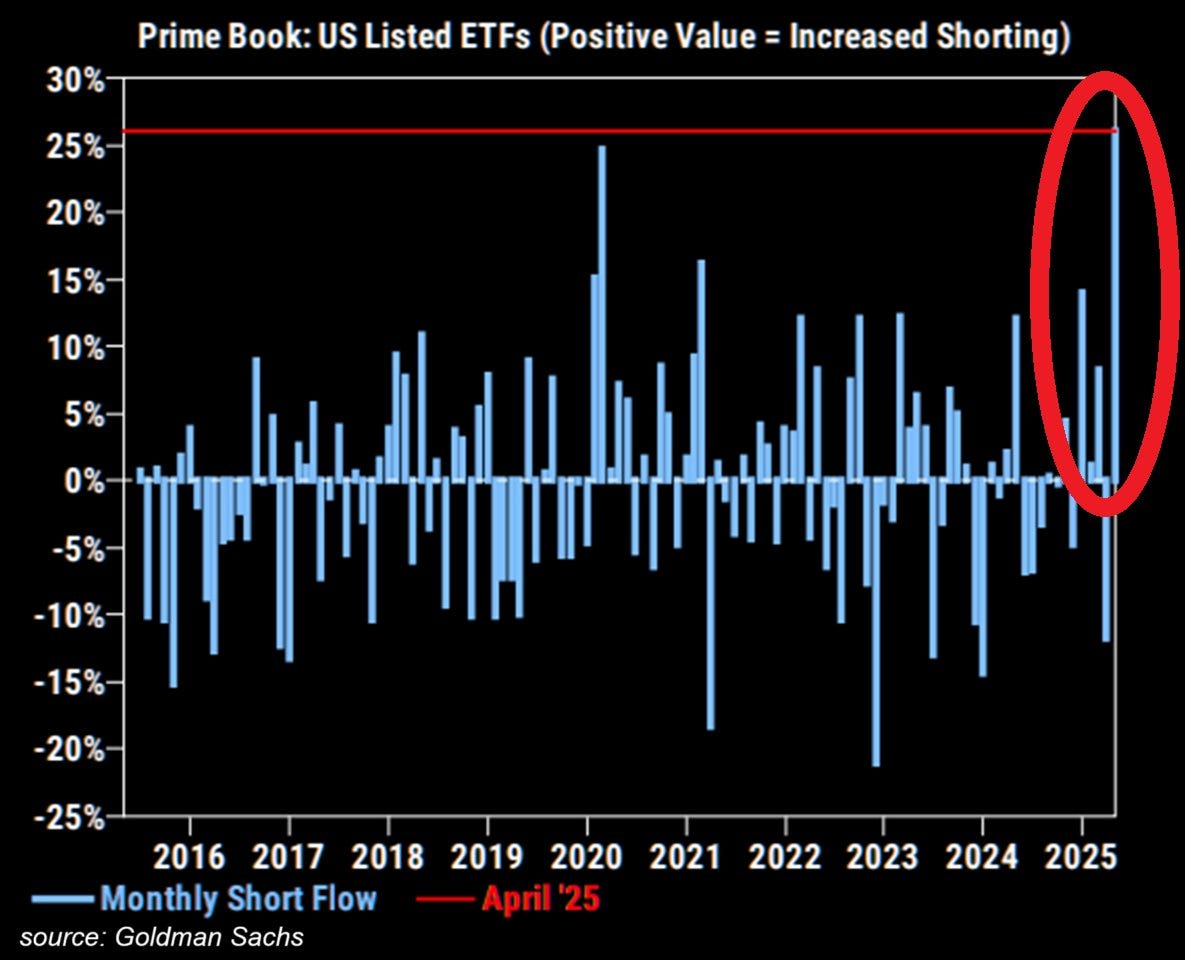

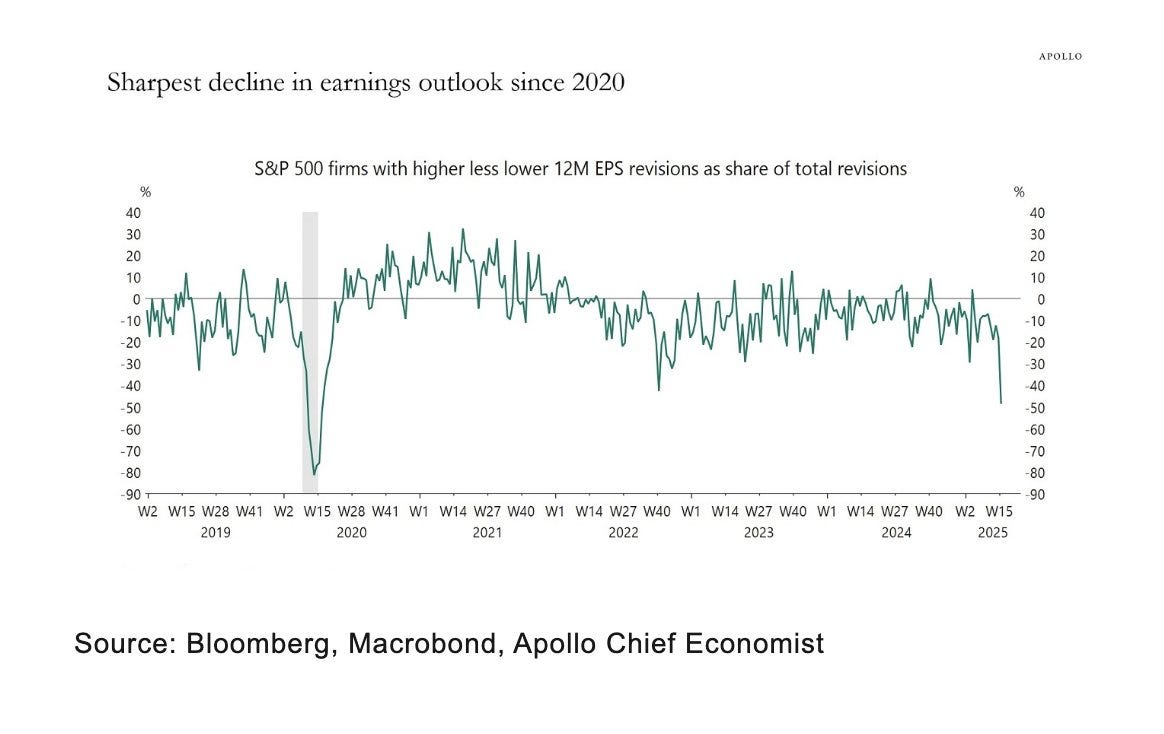

For the time being, retail investors don't seem to be anticipating a slowdown in consumption, nor fearing a recession. They invested a net $12 billion in S&P 500 stocks this month, the most in over a year: This massive influx into equities is benefiting technology and financial stocks:Since the market peak in February, retail investors have been buying on an almost daily basis, demonstrating sustained confidence despite recent volatility.This trend underlines a noticeable change in the behavior of retail investors, who continue to invest actively in equities, even in times of economic uncertainty. Conversely, institutional investors are adopting a more cautious, even bearish attitude. In April 2025, hedge funds recorded a record level of short selling on US ETFs, surpassing the peaks seen during the stock market crash of 2020 : This positioning reflects a sharp turnaround in analyst sentiment towards S&P 500 corporate earnings, with a significantly higher proportion of downward revisions to 12-month earnings forecasts: This is the sharpest deterioration since the Covid crisis in early 2020. It comes against a backdrop of great macroeconomic fragility: exploding Treasury borrowing requirements, monetary tightening, weakening world trade and resurgent trade tensions. This type of signal generally appears before or at the heart of a cycle turnaround. What makes it all the more striking is that it occurs at a time when stock market indices are holding at high levels, supported by massive flows of retail investors, while institutional investors are actively hedging against a possible correction. This divergence could herald instability on the markets if future results confirm this fundamental pessimism. The ability of the United States to reduce its deficit without triggering a deep recession will be a key factor in the future evolution of the gold price. Jerome Powell has kept rates unchanged, but this monetary status quo is not enough to restore confidence. With concerns about the US fiscal trajectory on the rise, expectations are now focused on fiscal discipline. In the absence of clear signals on deficit control, the market could continue to doubt the sustainability of US public finances, which would weaken the dollar and put pressure on long rates. If Washington manages to stabilize its public finances while maintaining moderate growth, pressure on the dollar and real interest rates could ease, temporarily weighing on the price of the precious metal. On the other hand, if the current dynamic - marked by an accelerated widening of the deficit, consumption on credit, and a gradual disengagement of foreign creditors - leads to a loss of confidence in US fiscal sustainability, physical gold, already considered a safe haven, could establish itself as the ultimate systemic safe haven, outperforming all other asset classes in times of global monetary disorder. In such a scenario, the aim would no longer be to hedge a simple cyclical risk, but to protect capital against a lasting loss of bearings in the international financial system.

Arabic

Arabic

Chinese

Chinese